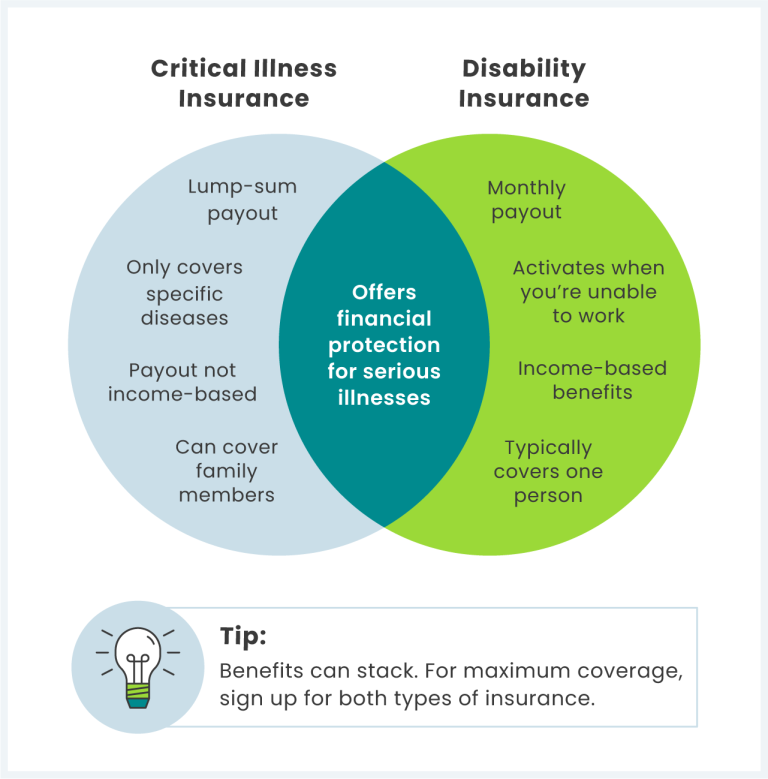

With medical insurance, a policyholder gets a certain amount of their medical costs paid for by the insurance company offering the plan. With disability insurance, the recipient gets a percentage of pre-disability base salary—usually up to 60 percent. Critical illness insurance, on the other hand, offers a lump-sum payment based on the terms.. Critical illness vs disability insurance: Key takeaways. Critical illness insurance covers one-time medical costs. Disability insurance replaces monthly income. Critical illness payouts are a tax-free lump sum. Disability benefits are tax-free, and replace 60-70% of income. Neither insurance type has tax-deductible premiums.

Ryan Inman, Author at Financial Residency

Critical Illness Insurance and Why You Need It Critical illness, Critical illness insurance

Critical Illness Insurance YouTube

Know The Difference Critical Illness vs Cancer Insurance Plans InsuranceFIRST.sg

Life Insurance With Critical Illness Critical Insurance Illness Assurance Vs Protect Situations

Critical Illness Insurance vs. Disability Insurance Differences!

Critical Illness Insurance What Is It and Do I Need It?

About Critical Illness Health Insurance Plan

WhatstheDifferenceBetweenCriticalIllnessInsuranceandDisabilityInsurance_20220721

Critical Illness Insurance Vs Disability Insurance

Critical Illness and Disability Insurance Quility

Chronic Illness vs. Disability Key Differences SYNERGY HomeCare

What Does Critical Illness Insurance Cover and Do You Need It

Pin on Health Condition Help

What is Disability Insurance and Why You Need it Debbie Sassen

Critical Illness Insurance Insurance Hai Must Iffco Tokio Insurance, Renewal, Claim, Premium

Differences of Critical Illness and Disability Insurance

I have a medical insurance plan, should I get a Critical Illness plan as well? Zigverve

Disability, Critical Illness and Life Insurance post COVID19 — The Living Benefits Group

Disability Insurance vs. Critical Illness Insurance Life Insurance Canada

Critical illness insurance premiums often cost well under $100 a month, and may be as low as $25 a month. Liberty Mutual offers critical illness insurance premiums for as low as $12 a month — for a 35-year-old nonsmoking male in good health who would receive a $30,000 payout. Your premiums depend on factors such as: Your age Your health. Critical illness insurance helps provides a lump sum payout if diagnosed with a specific condition, while disability income insurance replaces lost income if unable to work due to illness or injury. Using both policy types can maximize financial protection in the event of a serious health issue. Updated October 19, 2023.