2. Leverage Data Extraction Tools for Documentation. In the digital age, paper receipts can get lost, leading to missed VAT reclaim opportunities. Tools like ReceiptBank and Hubdoc can digitize and categorize these documents, attaching them to the corresponding transactions in your accounting software.. If your company makes taxable supplies of goods or services below a certain annual limit, it may be exempt from VAT. This means you will not pay VAT to the tax administration but you will then not be able to deduct the input VAT or to indicate VAT on invoices. You may — if you choose — voluntarily opt for the normal VAT arrangements, in.

Avoid paying VAT when you Export; Import and Export in Italy YouTube

How Do You Avoid Paying VAT on a Yacht? Guide 2023

How to Avoid Paying VAT on Prototypes Imported to the UK

Are You Paying Too Much VAT? Elite Accounting Leicester

How Do You Avoid Paying VAT on a Yacht? Guide 2023

WH Smith continues to demand boarding passes from passengers to avoid paying VAT The

Is Vat Applicable On Commercial Rent

Claiming a Tax Treaty Benefit in a Foreign Country or Want to avoid Paying VAT? Make Sure You

Paying vat stock photo. Image of kingdom, financial, coin 43285846

How To Avoid Paying VAT As A Business Searche

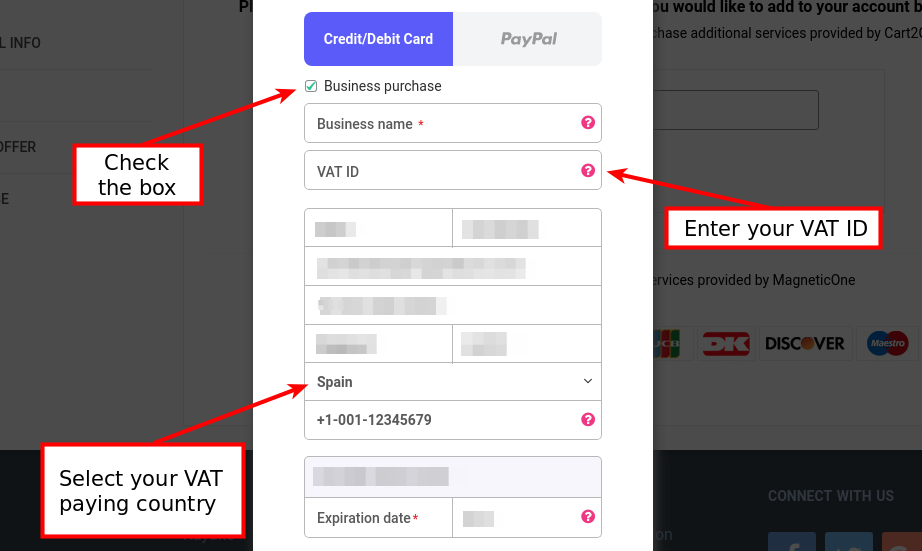

How to avoid paying VAT? Cart2Cart FAQ

How Do You Avoid Paying VAT on a Yacht? Guide 2024

How Much RRSP Should I Contribute To Avoid Paying Taxes?

How to avoid paying £130,000 in VAT registration fees if you export to EU Small Business UK

How Do You Avoid Paying VAT on a Yacht? Guide 2024

How to Avoid Paying VAT on Commercial Property UK

How Do You Avoid Paying VAT on a Yacht? Guide 2023

How Do You Avoid Paying VAT on a Yacht? Guide 2023

Orange Order puts Scottish HQ up for sale after bosses ‘tried to avoid paying VAT’ The

3 Ways Businesses Can Avoid Paying VAT In The UAE

Strategies to Avoid Paying VAT. 1. Purchase from VAT-exempt suppliers: One common strategy is to purchase goods or services from suppliers that are exempt from VAT. This can include products like books, educational services, healthcare, and certain types of food. By choosing VAT-exempt suppliers, you will not be charged VAT on your purchases. 2.. To be eligible for the Flat Rate VAT Scheme, a business’s VAT taxable turnover must be £150,000 or less. It’s essential to note that this figure refers to the expected turnover for the next year, not the past year. If during the year, your turnover exceeds £230,000 (including VAT), you’ll need to exit the scheme.