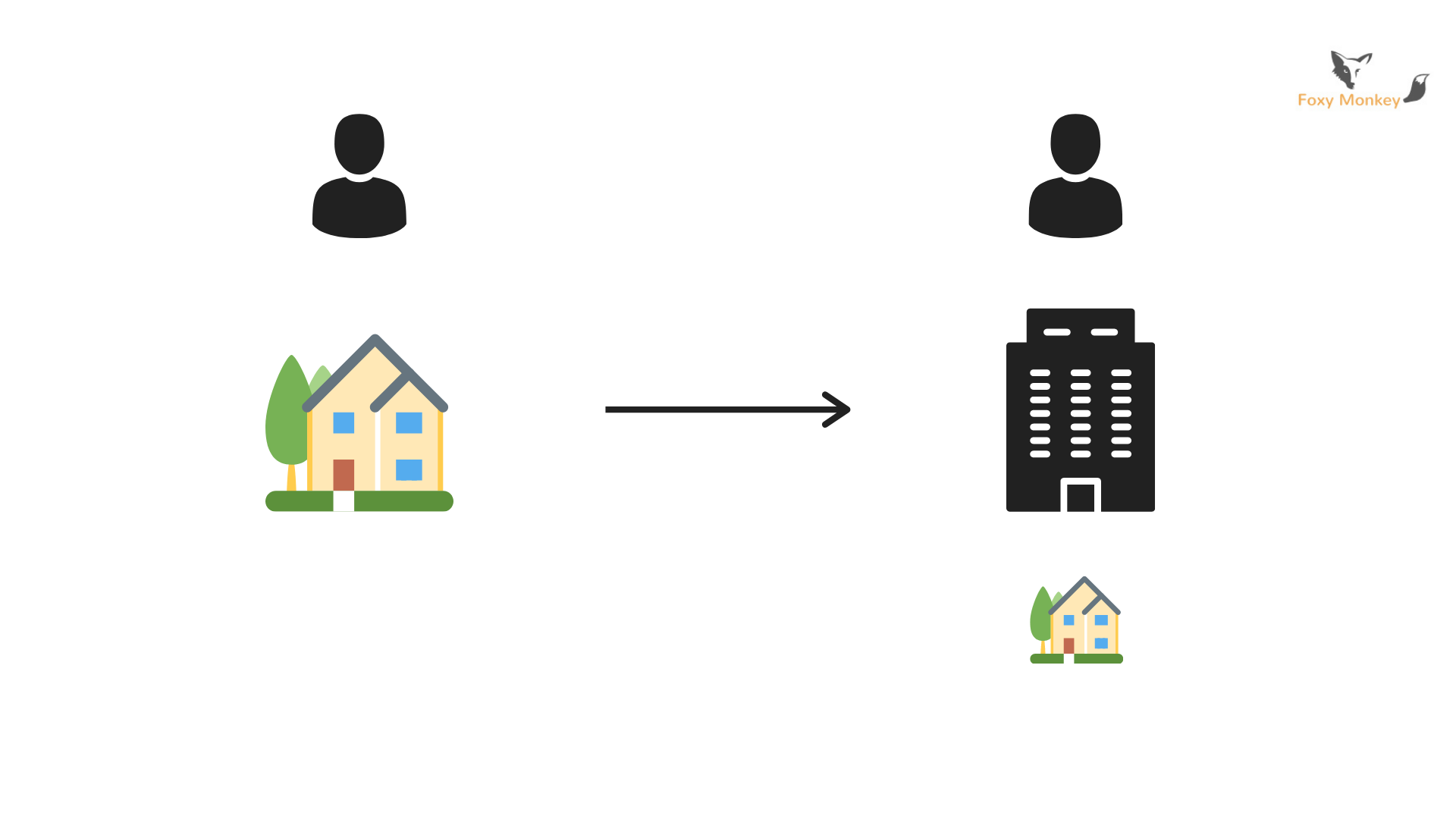

This is because moving your personally owned buy to let portfolio into a Limited Company is legally a sale and purchase transaction. This means that the process is subject to the same additional taxes, costs and fees as any other property purchase. These would include stamp duty, capital gains tax, legal fees and early redemption charges (if.. In summary, if you own a buy-to-let as a sole trader, you will pay: 0% Income Tax on the first £12,570 of income due to the Personal Allowance. 20% Income Tax from £12,571 to £50,270. 40% Income Tax from £50,271 to £150,000. 45% Income Tax on anything above £150,000.

75 LTV Limited Company BuyToLet Mortgages Unveiled by The Nottingham Estate Agent Software

Buy To Let Limited Company

Buytolet mortgages through a Ltd company explained Investment Property Forum

10 Things To Consider When Buying Property Through a Limited Company

Do Landlords Need To Set Up A Buy To Let Limited Company?

Buying Property Through a Limited Company CMME

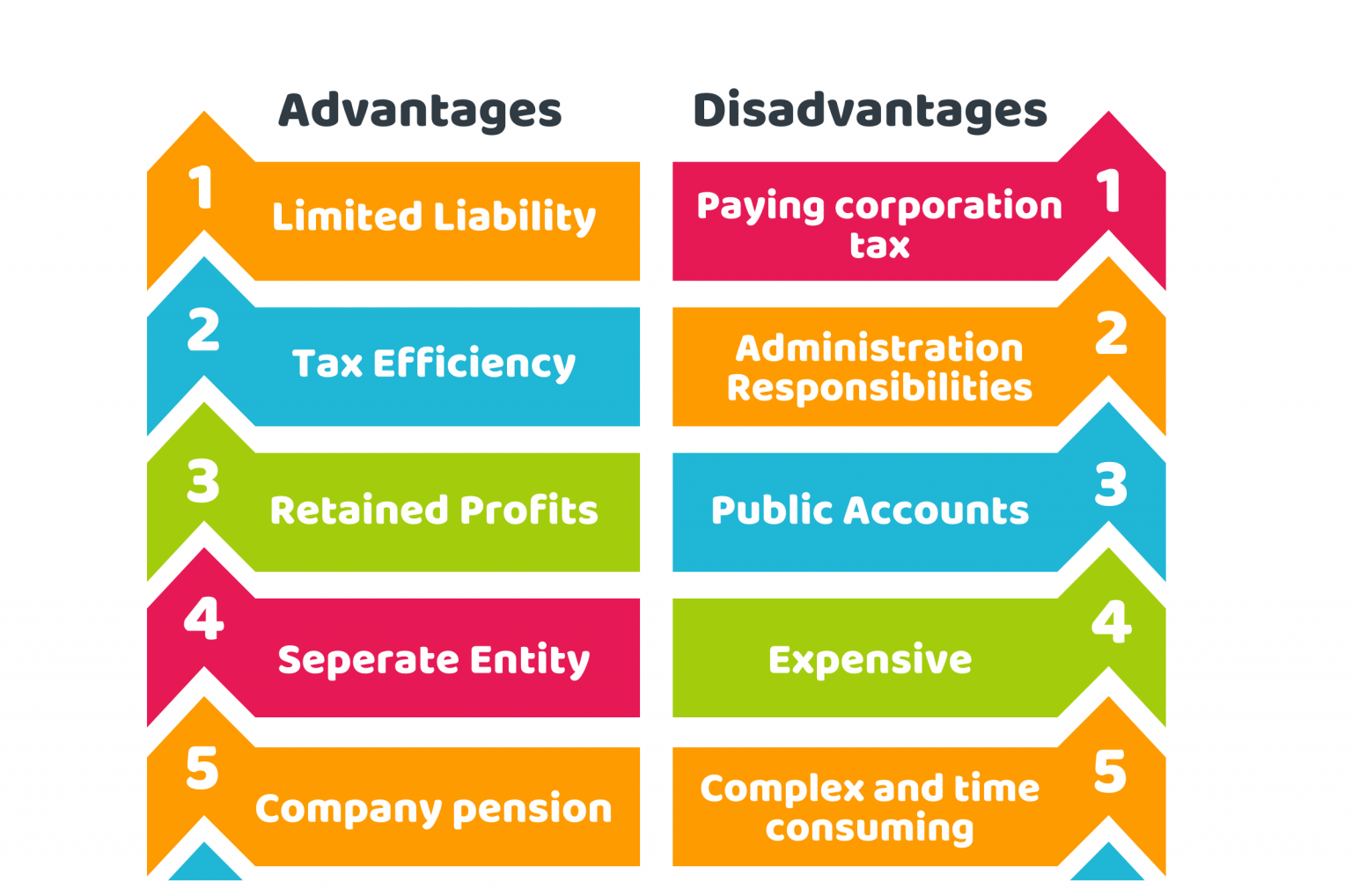

Advantages & Disadvantages of a private Limited Company CruseBurke

Should I Invest through my Limited Company or Personally? PennyBooks

Buying Property Through a Limited Company… But How Many?! Limited Company Property Investors

Limited company buy to let VA Mortgages

Overview of Private Limited Company SPAY & CO

Leasing an Electric Car Through a Limited Company MCL

Buying Property through a Limited Company Pros & Cons Foxy Monkey

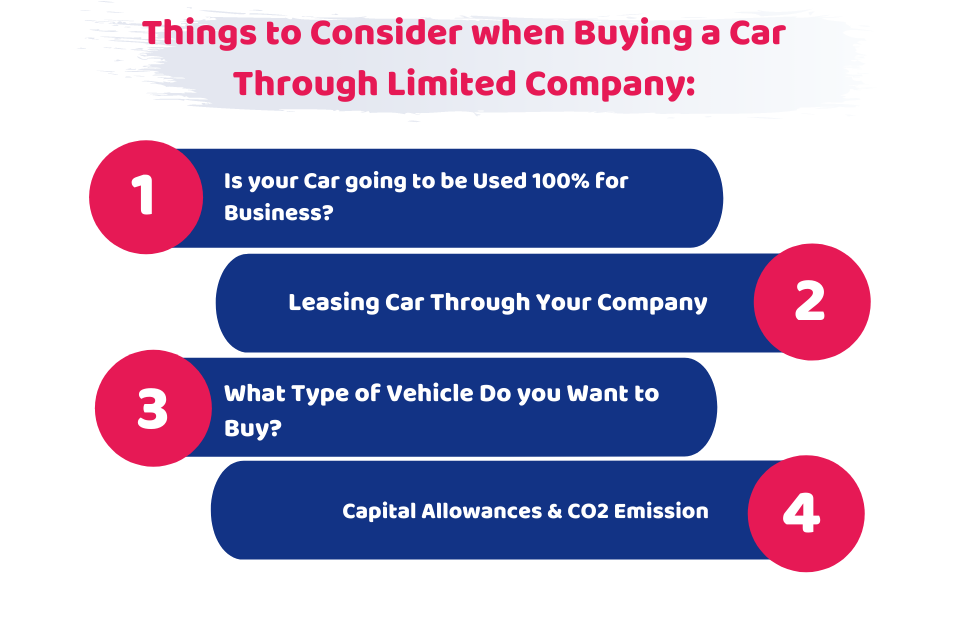

Save Tax Buying A Car In Your Limited Company Save Tax

Things to Consider when Buying a Car Through Limited Company

BuyToLet Mortgage Through A Limited Company Landmark Private Finance

Pros and cons of buying a property through a limited company Aberdein Considine

Property118 The Benefits Of Property Investment Through a Limited Company When Buy To Let

Limited company debts Can I be made personally liable? Future Strategy

Buy to Let Limited Company Mortgage Niche Mortgage Broker

The choice to purchase a buy-to-let property either as an individual or through a limited company has its advantages and disadvantages to consider. Buying as a limited company is the preferred choice for some people because of the obvious tax benefits and the protection of personal assets from losses if the investment goes wrong.. Buying a buy-to-let property through a limited company has become increasingly popular in recent years. There are several advantages to this approach, particularly for property investors looking to expand their portfolio. Tax Benefits. One of the biggest advantages of owning a buy-to-let property through a limited company is the potential tax.