Executives, analysts, and investors often rely on internal-rate-of-return (IRR) calculations as one measure of a project’s yield. Private-equity firms and oil and gas companies, among others, commonly use it as a shorthand benchmark to compare the relative attractiveness of diverse investments. Projects with the highest IRRs are considered.. PK. On this page is an Internal Rate of Return calculator, or IRR calculator. Enter the cash flows of an investment (or planned investment) in evenly spaced periods, and the tool will tell you your periodized rate of return. In the tool below, enter whether you are putting money into an investment using a negative number or receiving money back.

PPT Engineering Economics Internal Rate of Return (IRR) and Other Metrics PowerPoint

What is IRR? Formula, Calculation, Examples Bizness Professionals

PPT Capital Budgeting PowerPoint Presentation, free download ID3867325

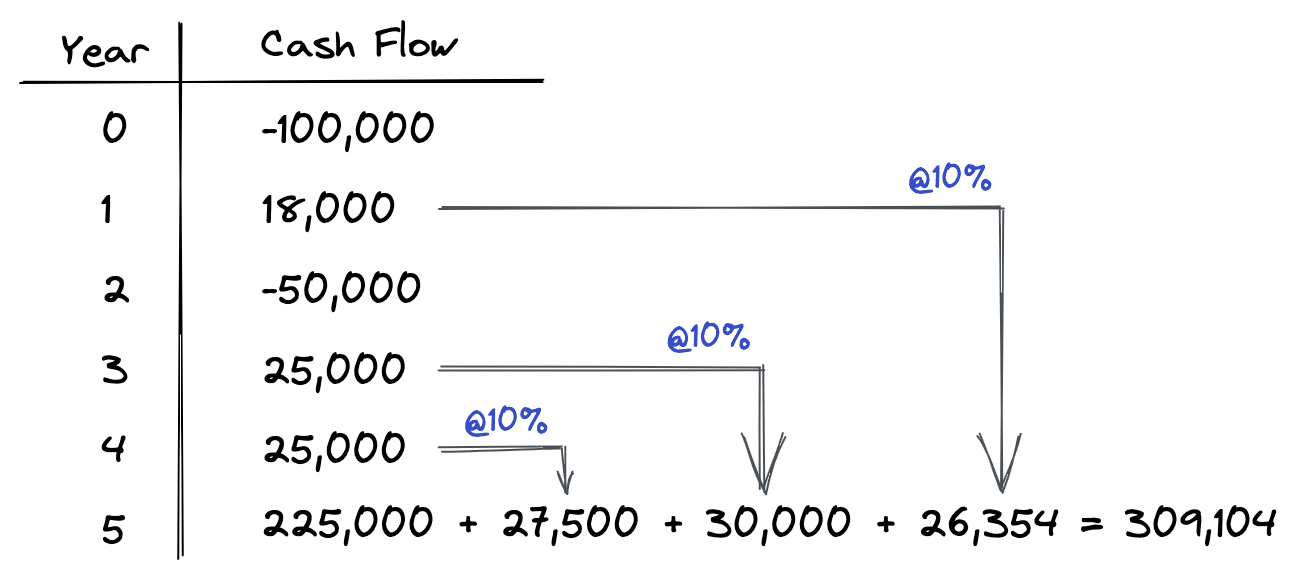

How to Use The Modified Internal Rate of Return (MIRR) PropertyMetrics

Internal Rate of Return (IRR) Rule AwesomeFinTech Blog

Internal Rate of Return (IRR) How to use the IRR Formula

Internal Rate of Return Formula Derivations, Formula, Examples

What is IRR? Formula, Calculation, Examples Bizness Professionals

PPT Chapter 10 The Basics of Capital Budgeting Evaluating Cash Flows PowerPoint Presentation

Internal Rate of Return (IRR) What You Should Know PropertyMetrics

PPT Internal Rate of Return (IRR) PowerPoint Presentation, free download ID2528370

Internal Rate of Return (IRR) Definition, Examples and Formula

The Internal Rate of Return (IRR) Part 2 YouTube

8.the Rate Of Return Method 970

Internal rate of return method for investment appraisal

Microsoft Excel 3 ways to calculate internal rate of return in Excel

Internal Rate of Return Meaning, Formula and Usage

Internal rate of return (IRR) What is, calculation and examples

What is Internal Rate of Return (IRR)? And How Does it Works?

How To Calculate Internal Rate Of Return Equity Haiper

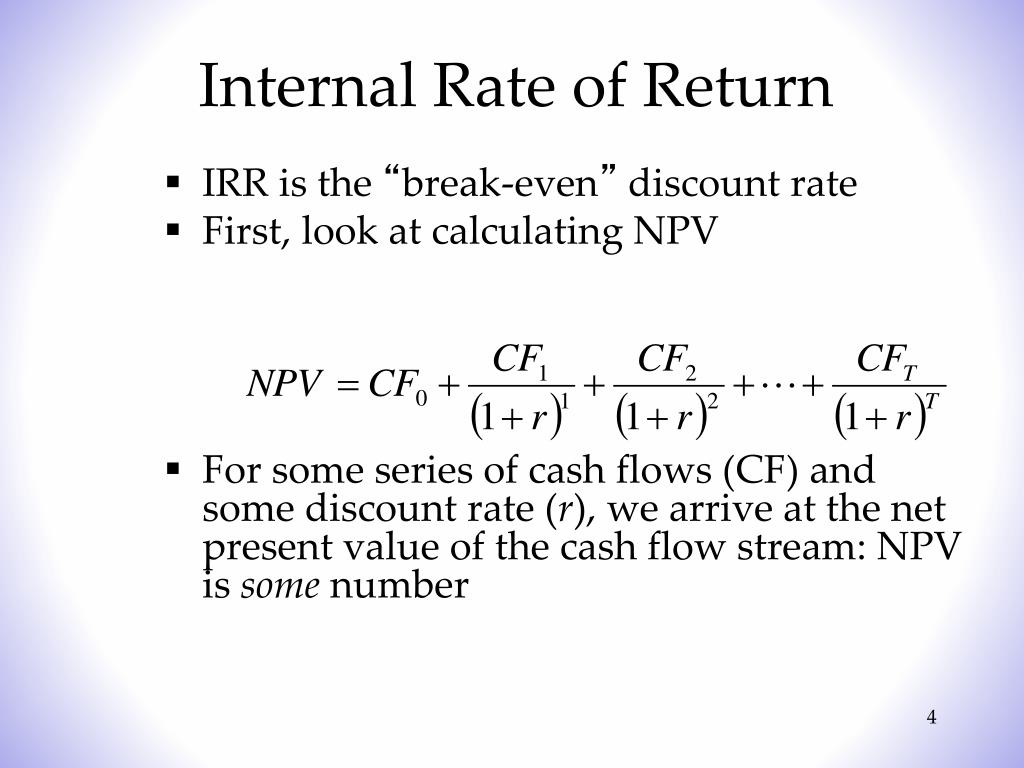

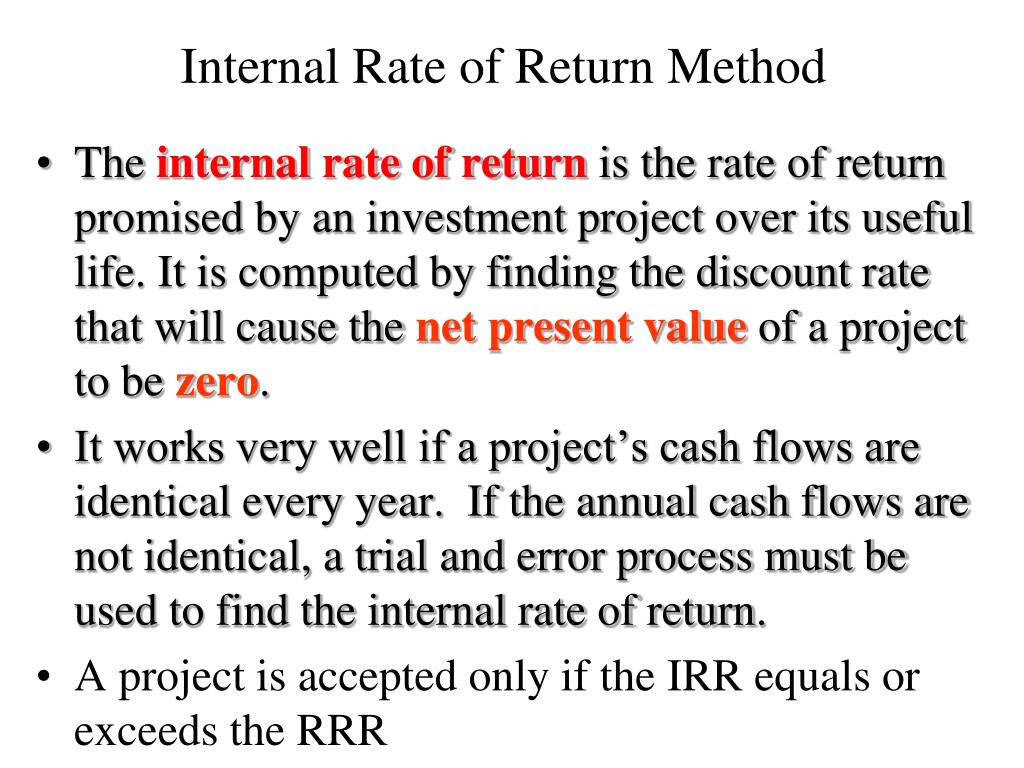

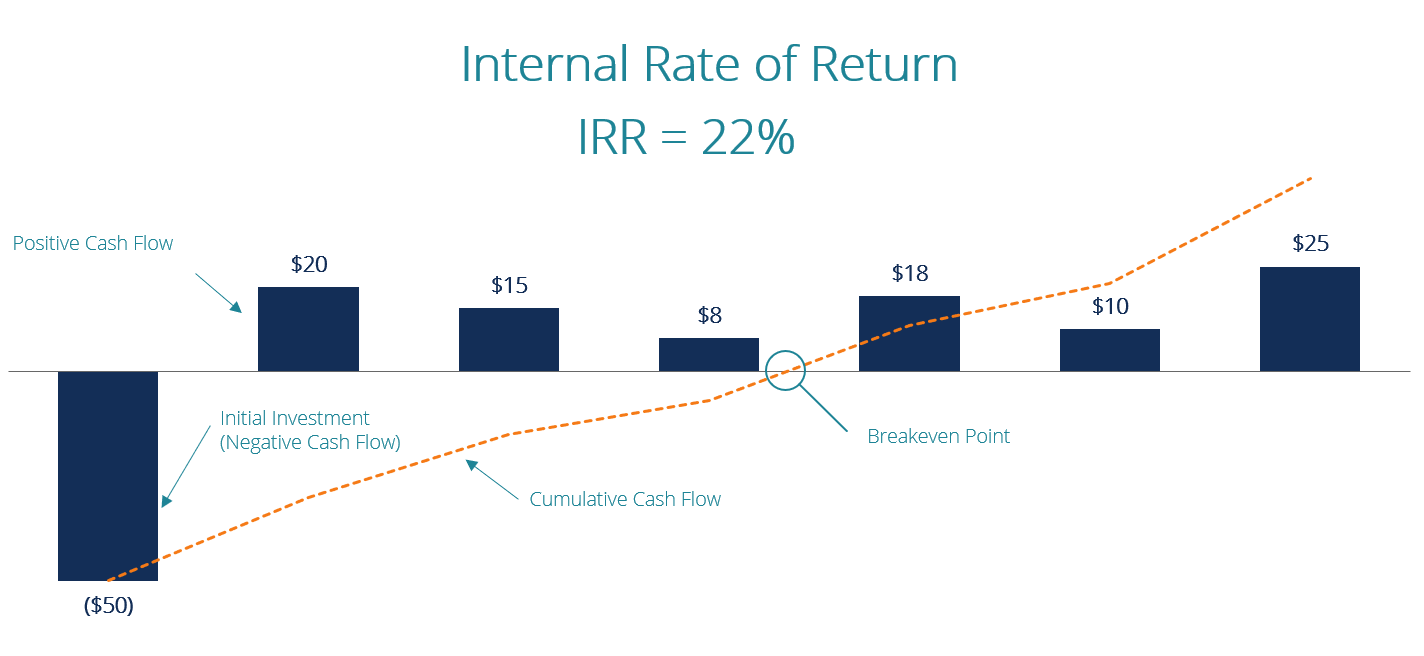

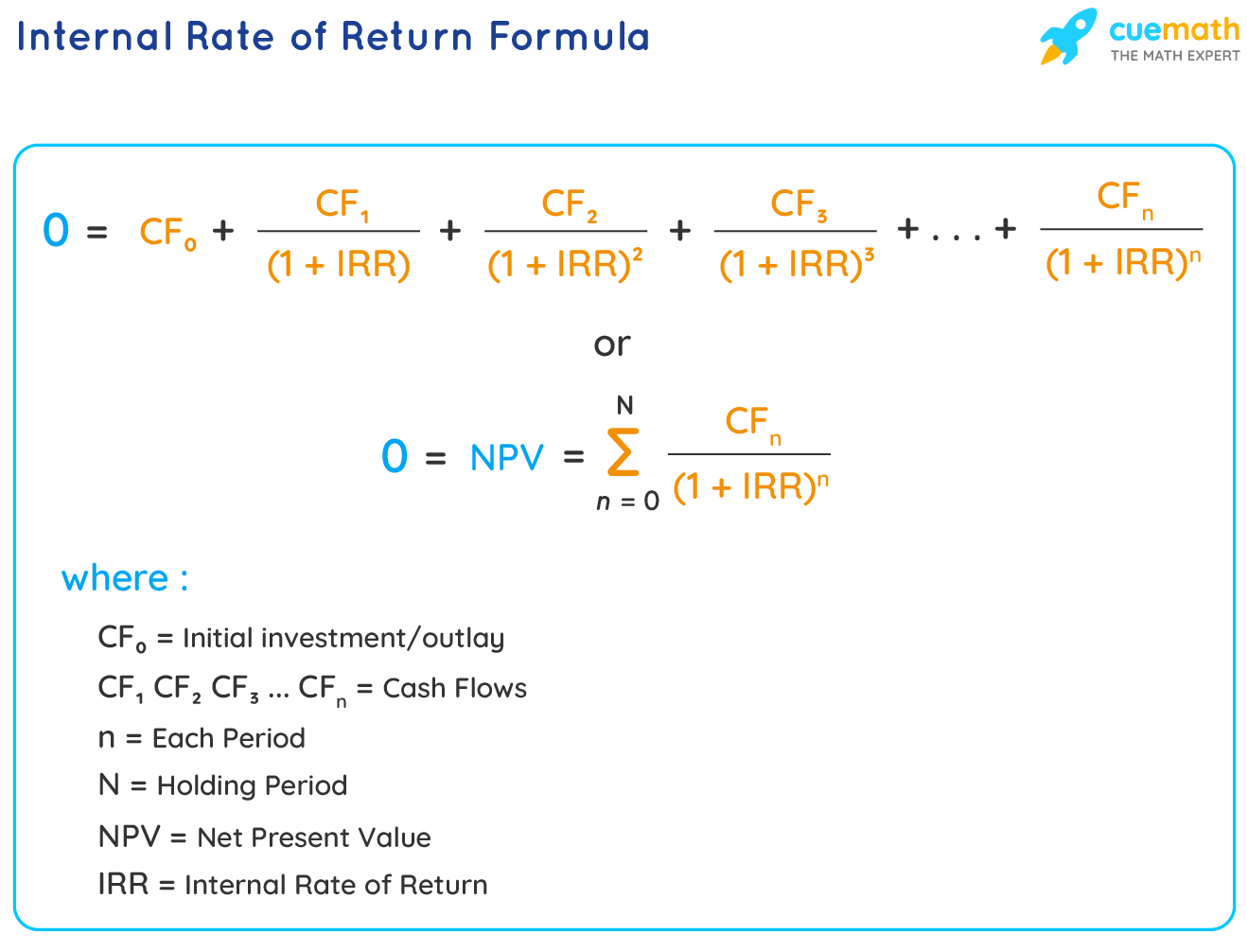

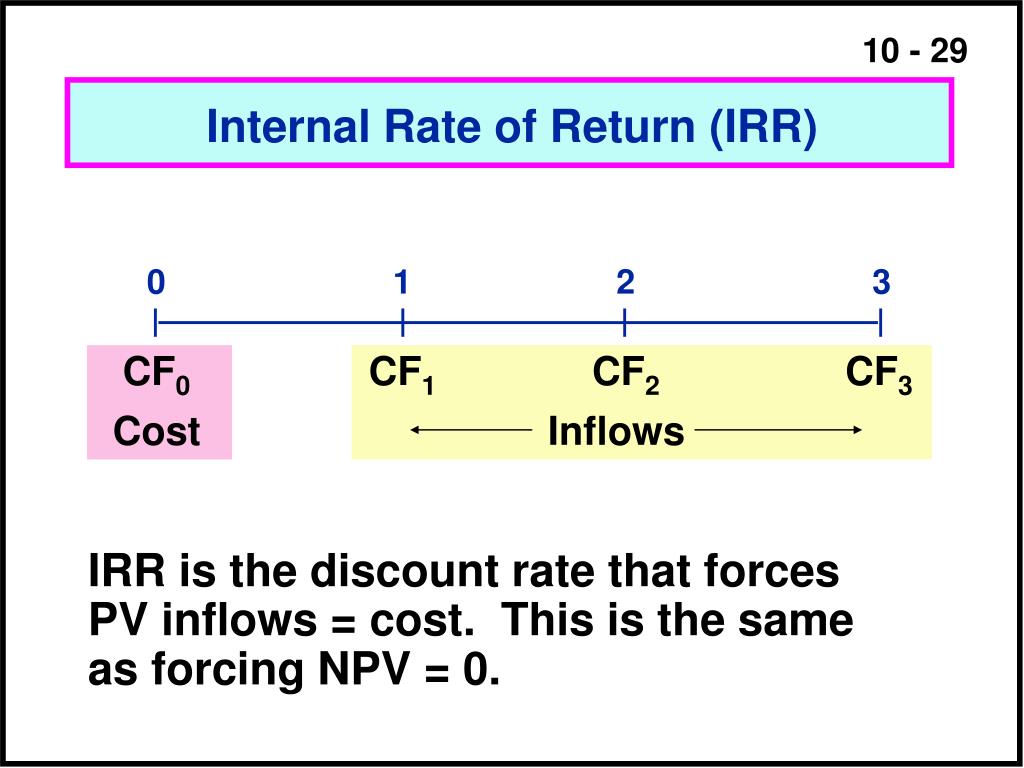

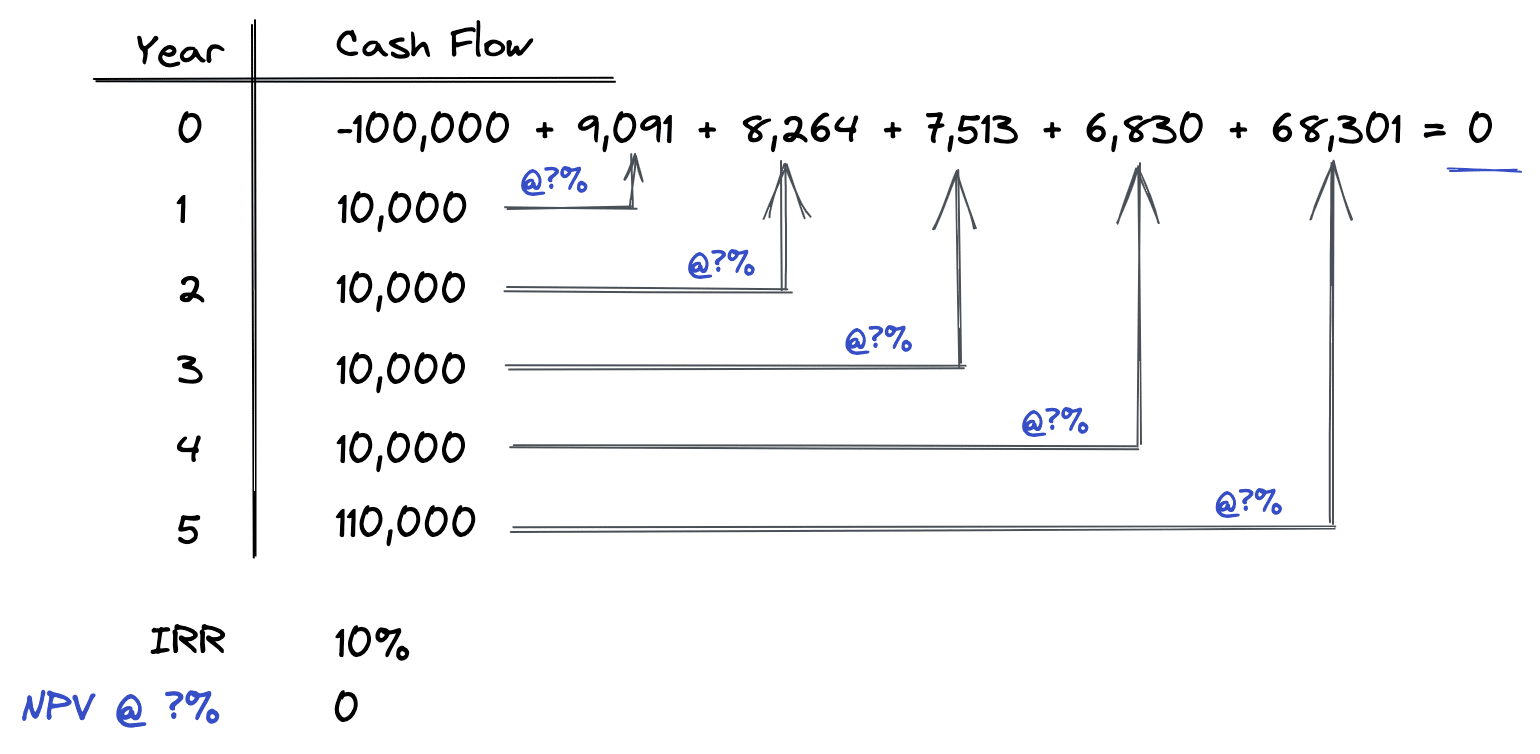

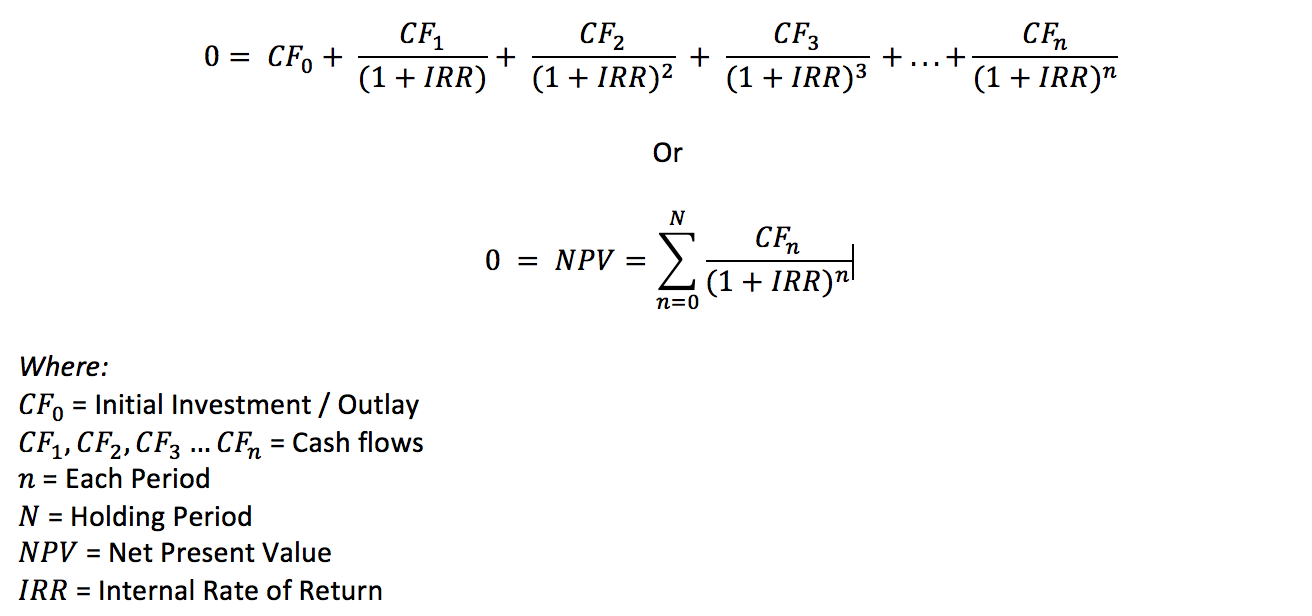

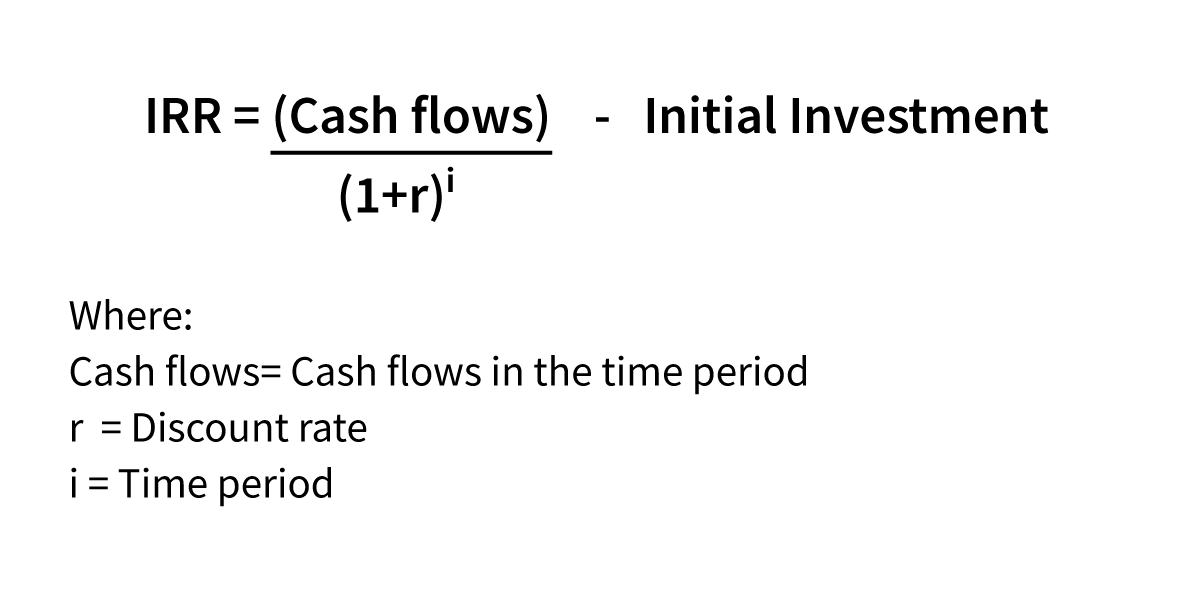

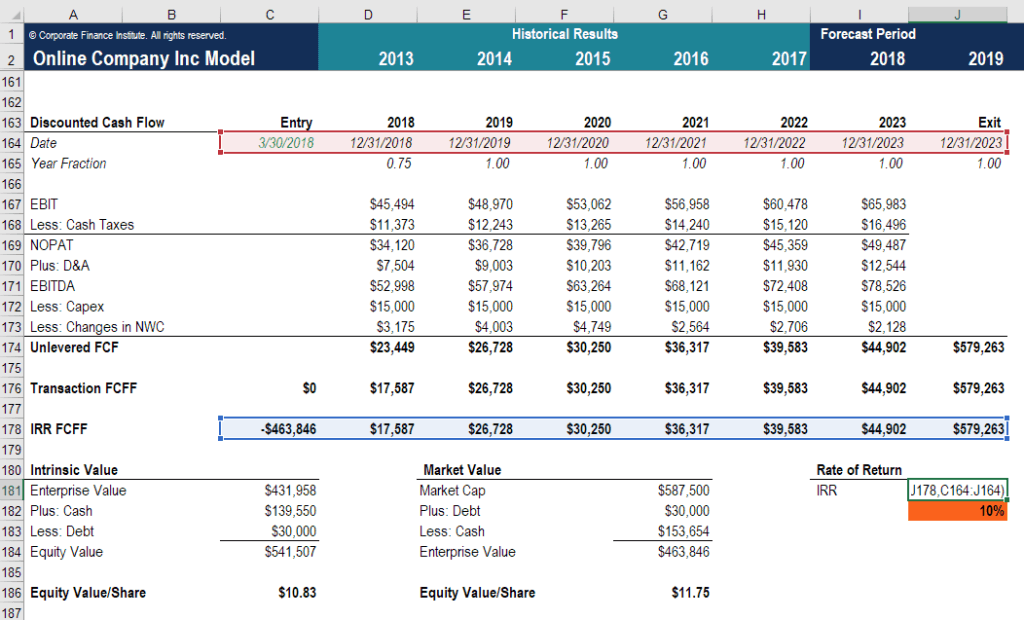

How to Calculate IRR. The internal rate of return (IRR) metric is an estimate of the annualized rate of return on an investment or project. Capital Budgeting → The internal rate of return (IRR) is the discount rate at which the net present value (NPV) on a project or investment is equal to zero, i.e. the discounted series of cash flows are of equivalent value to the initial investment..