The primary distinction between a limited company and a sole trader is the level of personal liability and ownership structure. Sole traders have unlimited personal liability, while limited companies offer limited liability to shareholders, reducing personal financial risk. Be careful when it comes to a limited company vs sole trader tax.. The Limited Company Tax Calculator allows you to see a breakdown of your tax if you are self-employed through a limited company. 2023 / 2024 values are used to show you how much you get to keep. More information about the calculations performed is available on the page.

difference between sole proprietorship partnership and company in table Dorothy Davies

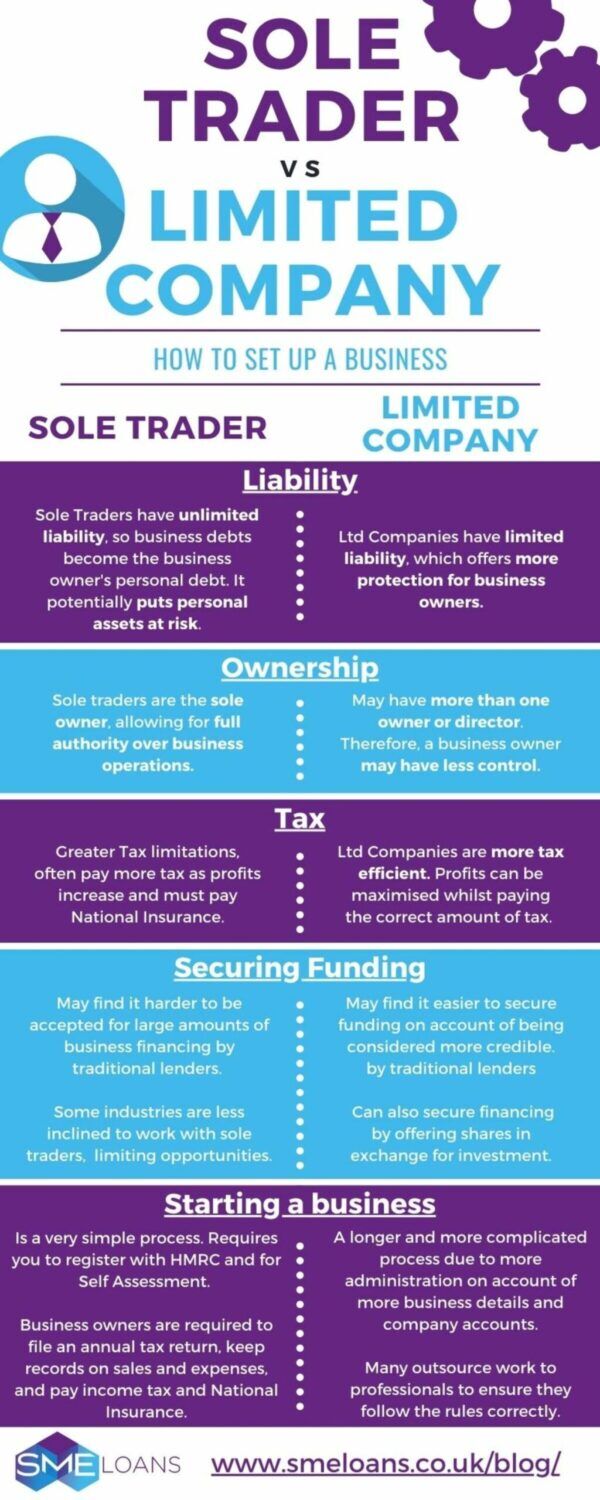

Sole Trader vs Limited Company How to set up a business SME Loans

The sole trader’s checklist infographic Talented Ladies Club

Limited company vs. sole trader what’s the difference and how do I register? Tamar

Starting a Business Sole Trader vs Company

SOLE TRADER Text on Sticker on the Chart ,with Calculator and Magnifier Stock Photo Image of

LedgerMax

Self Employed The Complete Guide EC4U

Private Limited Company vs. Sole Proprietorship & Partnerships Lendingpot

Sole Trader vs Limited Company Which one is best for 2023?

Sole trader vs limited company A complete guide Finmo

Sole Trader Public Liability Tabitomo

structure of my business

Sole Trader vs LTD Companies a Comparison Tax differences

Sole trader v Ltd company tax calculator Start Up Donut

Sole Trader vs. Limited Company Australia Pros and Cons YouTube

Sole Trader vs Limited Company PayStream

Ltd Company vs Sole Trader What’s the Difference? Evenstone

Sole trader vs limited company All information

Pros and Cons of Limited Company vs Sole Trader Q Accountants

Why choose Ltd over sole trader? Choosing a limited company over being a sole trader offers benefits such as limited liability, tax planning opportunities, increased credibility, and potential for growth and expansion. How much can I pay myself from my limited company? As a director of a limited company, you can pay yourself a salary, dividends.. Sole trader vs limited company: let’s talk tax. We’re not trying to poop the party, but we are your friendly neighbourhood tax know-it-alls, so we’ll bring tax into it every time. So with that being said, let’s talk about the different tax implications and how they differ when you’re a sole trader vs a limited company.